IRS Cracks Down on $13B in Unreported Gambling Winnings

by .

After an audit revealed that Uncle Sam may have let more than $1 billion in income tax on recent casino jackpots go uncollected, the IRS is cracking down on the oversight. And one of Las Vegas’ most recognizable casino gamblers finds himself in the crackdown’s crosshairs.

The news was delivered by this Sept. 30 report from the independent IRS watchdog group Treasury Inspector General for Tax Administration (TIGTA). It found that 148,908 Americans with gambling winnings exceeding $15,000 failed to file tax returns between 2018 and 2020.

Their winnings exceeded $13.2 billion dollars, making the unpaid taxes just north of $1.4 billion.

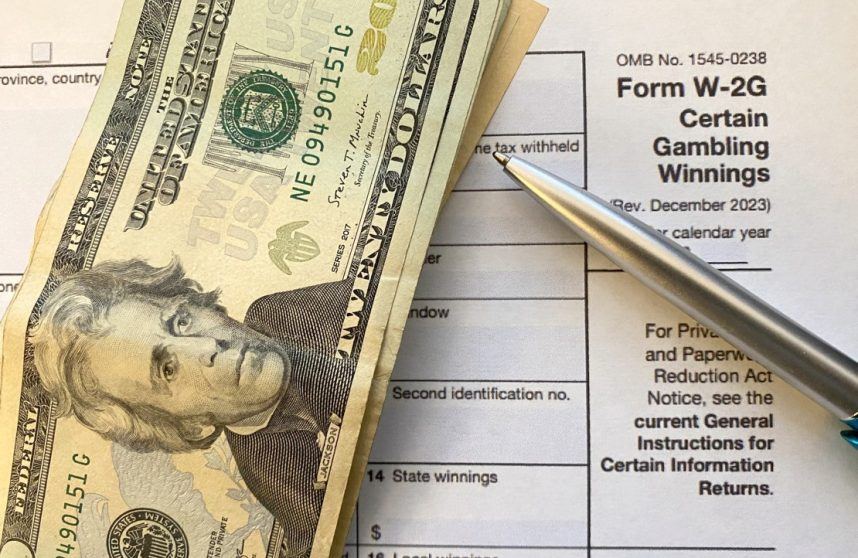

TIGTA analyzed the W-2G forms generated by casinos when gamblers hit slot jackpots of $1,200 or more or Keno wins of $1,500 or more. Its report noted that 103,000 of these delinquent winners were never issued notices or faced with efforts to bring them into compliance.

In a response to the report, the IRS wrote, “We agree with the recommendation,” vowing to begin enforcement actions.

The Internal Revenue Code states that gains from gambling are fully taxable and must be reported as income by individual taxpayers. Gambling losses may be deducted for filers itemizing up to the amount of their winnings.

Other Findings

Among the TIGTA report’s other concerns were hundreds of W-2Gs that were filed by casinos without the required taxpayer identification numbers. This makes it extremely difficult for the IRS to trace the winnings to its recipients.

Also, the watchdog group noted, the IRS has too few processes in place to identify noncompliance with excise taxes by gambling operators, particularly in the rapidly growing online sports-betting market.

The IRS also agreed with the latter recommendation. However, it disputed the significance of the W-2Gs without taxpayer IDs, since the number was small.

“While this population may not be large in absolute terms, we believe that the amount of backup withholding that should have been withheld is significant,” TIGTA responded.

Code Adjustments

Form W-2G’s Summary of Withholding Requirements doesn’t currently single out earnings from sports gambling or iGaming. Sports betting is among the fastest-growing sectors of the U.S. gaming industry, with retail and/or online sportsbooks regulated in 38 states and Washington, D.C.

The IRS has obliged to specifically inform taxpayers of their filing requirements for sports betting and online casino gambling winnings.

“Form W-2G has not evolved with the growth of the gambling industry,” TIGTA’s report read. “For example, the wager codes on Form W-2G include only nine specific types of gambling activities, which do not include a wager code for sports betting. If there was a wager code specifically for sports betting, the IRS could use this information to identify potential non-filers and under-reporters.”

The Treasury estimates that U.S. taxpayers underpaid their federal taxes by $688 billion in 2021, with non-filers responsible for 11% of the unreceived funds. The IRS’ Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The maximum penalty is 25% of the unpaid tax.

The IRS typically reserves criminal prosecution for exceptional cases where massive fraud and tax evasion evidence is rampant.

Vital Error

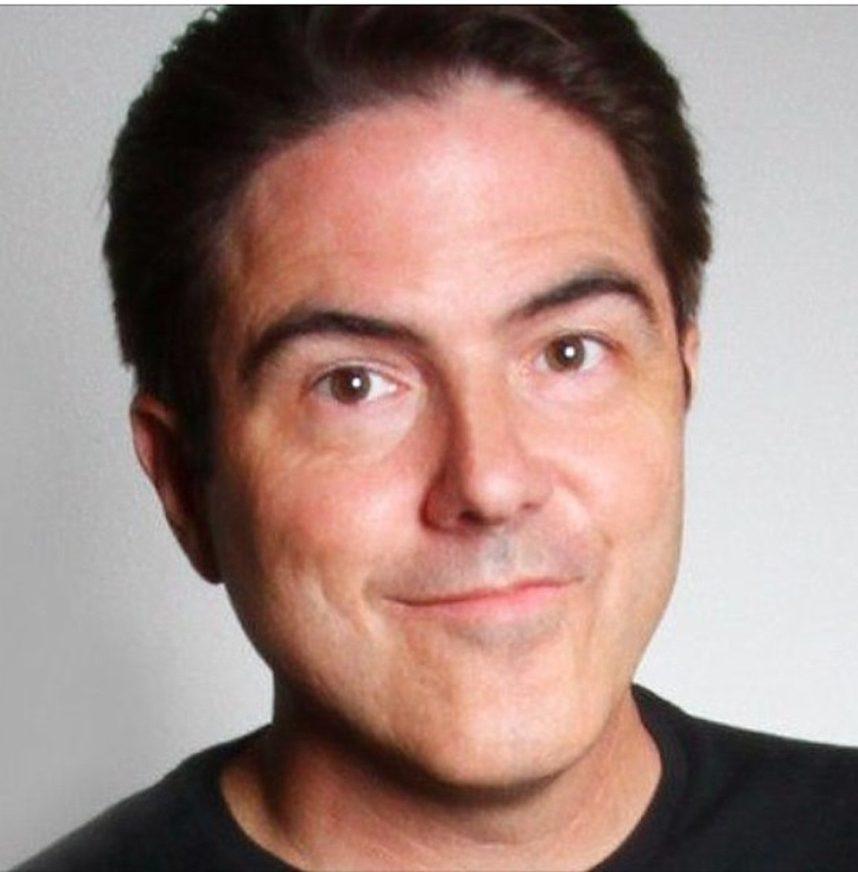

Last month, Scott Roeben, founder of Casino.org’s own Vital Vegas, received an IRS audit letter regarding taxes on $100,000 in unreported W-2G income in 2022.

The letter gave him 30 days to respond with specific four-year-old documentation or “further steps” would ensue.

The only problem, Roeben says, is that he filed his 2022 tax return on time, with all gambling income reported.

“I filed everything properly,” he said. “I just had a large number of jackpots, so that triggered the audit, presumably.”

Roeben called the IRS’s campaign “selective persecution of casino patrons because of the stigma attached to gambling,” adding that it demonstrates “how out of touch the IRS is with the reality of gambling.”

“This is making people jump through hoops, spend money on tax professionals to help with their audits and reconsider a pursuit they enjoy,” he says, adding that, even in the case of tax cheats, “jackpots are far from the entire picture when it comes to gambling.

“It’s like saying passengers of the Titanic had an absolute blast for 2,070 miles.”

The post IRS Cracks Down on $13B in Unreported Gambling Winnings appeared first on Casino.org.

After an audit revealed that Uncle Sam may have let more than $1 billion in income tax on recent casino jackpots go uncollected, the IRS is cracking down on the oversight. And one of Las Vegas’ most recognizable casino gamblers finds himself in the crackdown’s crosshairs. The IRS form W-2G is issued for every slot…

Recent Posts

- Macau Legislative Assembly Passes Gambling Crimes Bill

- Clark County Honors Security Officer Who Saved Lives During Red Rock Stabbing Incident

- Regulator Cites “Serious” Misgivings About Two Favorites for New York Casino License

- 50 Cent Announces First-Ever Las Vegas Residency at Planet Hollywood

- Tip-Out Policy Change for Two Vegas Casinos Sees Dealers Almost Triple Earnings